I just finished reading Rework and am pumped to continue working on my side projects. I also just read an interesting post titled ‘I am a racist’ by Mark C. Chu-Carroll and they both really got me thinking.

I am a huge fan of 37signals (who isn’t these days?), and typically agree with their business philosophies and software development approach.

DHH recently had an interview with Jason Calacanis, where there was an interesting face-off between the two schools of thought. DHH is a major proponent of building your company from internal cash-flows and eventual profits, while Jason C. believes you should take outside funding when you can (I am simplifying here, so please don’t send hate mail if this doesn’t spell out their philosophies exactly).

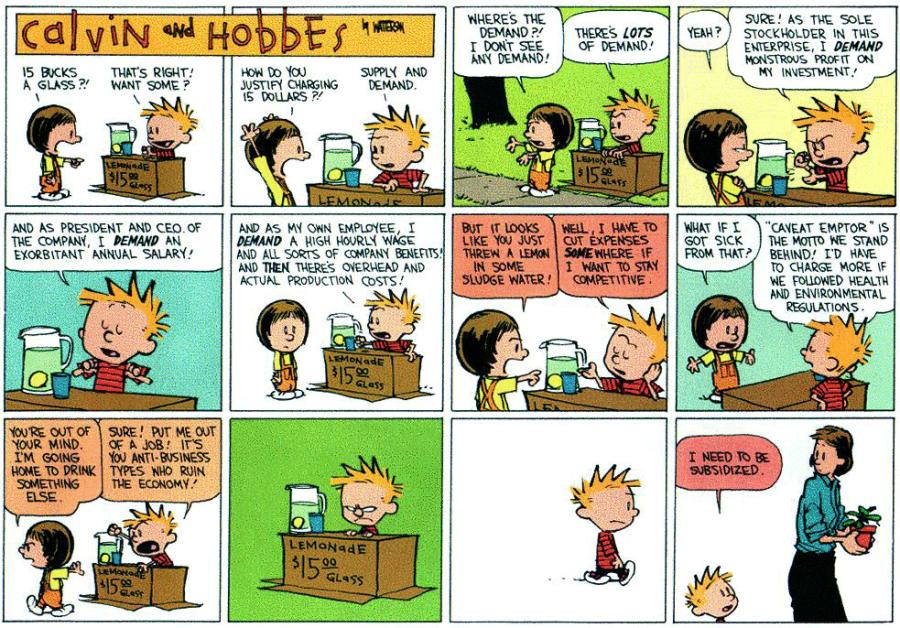

During this interview, DHH mentioned that you should always be working on your best idea – i.e. there is no reason for you to want to sell your company because there is no guarantee that you will come up with as good an idea, or even a better idea, the next time around. In his case, he can see himself still with 37signals in 20 years, because he is confident that he is working on his best idea now. He has no plans to exit. Jason Fried even went so far as to write a blog post blasting the sale of Mint.com to Intuit because Aaron Patzer (Mint’s founder) ‘sold out’.

During another interview with Jason Fried on Mixergy, Andrew Warner (the interviewer) challenged him about wanting to build a large business and Jason pushed back defending his stance about staying small.

There is a certain zen-like quality to these notions that Jason & DHH espouse, and I whole-heartedly adopt many of them. I understand, and agree with, Jason & DHH’s point about focussing on building a solid company based on profits and real customers rather than VCs and eyeballs. I also agree that large companies tend to be inefficient, cumbersome and slow-to-respond. I do acknowledge that there are inherent risks with leaving one successful venture behind. In that, it is possible that you will never be able to ‘strike gold’ twice and come up with more than one businesses that are as successful as the first.

However, where I fundamentally disagree with them on is the notion that we should never sell and stick to one company for many, many years (if not our entire entrepreneurial lives).

The reason I disagree is because by the very nature that I have the ability and wherewithal to build a large successful company and sell, there is a high probability that I can do it again (when I say I, I mean anyone – not me specifically, but hopefully me in the future:) ). This ability is so rare, that those that have it, should not squander it – for the advancement of our civilization and the betterment of society. I once heard, can’t remember from where, that the most effective poverty-reduction mechanism that mankind has ever seen is capitalism. Capitalism has raised the standards of living of more people than any other initiative and system before it – by a factor of many multiples.

As Warren Buffet said, the mere fact that we (able body entrepreneurs) won the ovarian lottery and were born to the right vagina comes with a certain amount of responsibility. Lady Luck (nothing we did to deserve it) allowed us to go to school, meet the right people, have access to information and resources – which hundreds of millions were not so fortunate. On top of that, we were given the ability to create companies that can create wealth for many shareholders, customers, clients & employees. I believe, this obliges us to build the best businesses we can (grow as much as we can – not necessarily in terms of bulking up employee count, but grow revenues and profits). If we get an offer to sell, which could have a material impact on improving the financial security of said stakeholders, it should be seriously considered. Then do it again.

So, while I understand that they (Jason & DHH) are basically pushing back against the Silicon Valley ethos of coming up with an idea, seeking VC money, hiring a bunch of people, selling to the biggest gullible buyer and then chilling on mojito island for eternity. I think they tend to be a BIT too overzealous with the opposite stance.

Aaron Patzer (of Mint fame) is now free to start a foundation and have a more significant impact on many lives, than he had before, all the while investing in other companies and starting another one for himself.

The fact that he can, and hundreds of millions can’t, I believe means he has a fundamental responsibility to maximize his capabilities as much as possible.