Power of Words

I recently wrote a letter to the editor of one of the local newspapers, here in Jamaica.

The irony of it all, is that the way my letter was edited is that it can make me come across as politically divisive. That’s not what I meant. So, for all and sundry, here is the unedited version of my letter.

Dear Mr. Editor,

Shortly after President Obama took office, ex-Vice President Cheney did a major media blitz criticizing everything that the President did (keep in mind, that while he was VP, Cheney only spoke to the media a handful of times for his entire 8 years). Reporters were eagerly trying to get a comment from President Bush about the performance of Obama. He gave a response which surprised me. He said “I will give the current President the dignity of my silence”. Keep in mind this is after Obama basically won the elections on bashing Bush and tarnishing his legacy. This man, President Bush, took the moral high-ground of offering no critique.

Recently Mr. Seaga embarked on a similar media blitz, commenting on the joint Police/Military raid on Tivoli Gardens among other things. Some of his comments were, in my humble opinion, absolutely disappointing and potentially divisive. How dignified is it, for a former prime minister (of any party affiliation) to be criticizing the character of the current prime minister – in a relatively functional democracy? Can we have the former leader of the very party that Bruce Golding now chairs, coming out to bash him – even calling for his resignation?

This is not a debate of whether or not Mr. Golding should resign, but rather an analysis of key players in our young democracy.

If Mr. Seaga wants to comment on the state of the operations of Tivoli Gardens (given that he built it), I believe he has the right to do so. But, I would have hoped that, given Mr. Seaga’s political savvy, he would play the role of elder statesman, take the moral high-ground and refrain from commenting specifically on Mr. Goldings’ performance. That’s the job of the opposition, the media and the people. Perhaps Mr. Seaga can take a lesson from Mr. Patterson.

On another note, we have a recent column from Mervin Stoddart titled ‘Dudus is not the real enemy’, published by The Observer. I am disheartened that the publication of such vitriolic statements would be allowed, where he wrecklessly spews comments like ‘the economies of capitalistic exploiters’, ‘earth’s evil Caucasians’, and ‘Already their multinational corporations are raping all nations socio-economically’. It is about time we all acknowledge the power of words and be held to greater account.

Yes, I agree that some actions of the past, by large countries could be viewed as ‘taking advantage’ of other countries/people, but how does it help the current state of affairs – in a world where all countries have to work together for the betterment of all countries – to be promoting these notions? People can change and with change, enemies of the past can become partners of the future. Comments like those only help to further divide and polarize thereby making partnership and progress that much more difficult.

Perhaps we have all been indoctrinated with the misleading and very damaging maxim that ‘Sticks and stones can break my bones, but words will never hurt me’. That statement couldn’t be further from the truth. Words send nations to war, cause people to commit murder, give an entire generation hope, mobilize an entire society against a common enemy, spur donations of millions of dollars to ravaged states and even talk a suicidal jumper off the cliff. As a society, we all need to start being more mindful of the words that we use. Especially starting with our current leaders and former leaders.

Sometimes, the best use of words, is no use at all.

Marc Gayle

Kingston, Jamaica

An Open Letter to Alexis Ohanian (Reddit Co-founder)

World Hunger {Infographic}

As a topic that is near and dear to my heart, this infographic prepared by the fine folks over at stripes39.com is absolutely interesting.

The Google Job Experiment

This is pretty ingenius. If I were hiring a creative guy, I would definitely hire this guy.

The Sheer Power of the US Military

We all know that the US military is powerful, but I think it is easy to underestimate exactly how powerful they really are. US Secretary of Defense Robert Gates was recently giving a speech at the Eisenhower Library on the 65th anniversary of the allied victory in Europe. He was pitching the case for cutting down the size of the defense budget, and addressing the concerns of many that America will lose it’s strength if defense spending is overhauled. He was quite confident that that wasn’t the case. Here is a choice excerpt (note, I added the emphasis):

Finally, this Department’s approach to requirements must change. Before making claims of requirements not being met or alleged “gaps” – in ships, tactical fighters, personnel, or anything else – we need to evaluate the criteria upon which requirements are based and the wider real world context. For example, should we really be up in arms over a temporary projected shortfall of about 100 Navy and Marine strike fighters relative to the number of carrier wings, when America’s military possesses more than 3,200 tactical combat aircraft of all kinds? Does the number of warships we have and are building really put America at risk when the U.S. battle fleet is larger than the next 13 navies combined, 11 of which belong to allies and partners? Is it a dire threat that by 2020 the United States will have only 20 times more advanced stealth fighters than China?

I am a military geek, so these numbers didn’t entirely startle me, but it did give me pause. To read the entire speech, check it out here. Upon reading this speech, it reminded me of an article that The Economist published some time ago. Choice excerpts are as follows:

THE Perseus, a 900kg (2,000lb) bomb made in Greece, incinerates almost everything in an area larger than a dozen football fields. Farther out, oxygen is sucked from the air and people may be crushed by a pressure wave. The inferno is similar to that caused by napalm—a jellied-petrol explosive heavily restricted by a United Nations weapons convention.

That was just the prelude. Here is a much more impressive excerpt:

On April 2nd 2003, during the second Gulf war, a hundred or so Iraqi armoured vehicles approached a far smaller American reconnaissance unit south of Baghdad. Responding to a call for help, a B-52 bomber attacked the first 30 or so vehicles in the column with a single, historic pass. It dropped two new CBU-105 bombs, and the result shocked the soldiers of both sides—and, soon enough, military observers everywhere.While falling, the CBU-105 bombs popped open, each releasing ten submunitions which were slowed by parachutes. Each of these used mini rockets to spin and eject outward four discs the size of ice-hockey pucks.The 80 free-falling discs from the pair of bombs then scanned the ground with lasers and heat-detecting infra-red sensors to locate armoured vehicles. Those discs that identified a target exploded dozens of metres up. The blast propelled a tangerine-sized slug of copper down into the target, destroying it with the impact and the accompanying shrapnel. The soldiers in the 70 vehicles farther back in the column surrendered immediately.

Afghanistan in April 2010 in Photos

Boston Big Picture has the best photo journal I have ever come across. It is one of the many reasons I love the internet, technology and photography. At no other time in history, could I sit 5,000 miles away from a place and see such rich representations in such a timely manner – almost instantly nowadays.

They recently published, essentially, the state of Afghanistan in April 2010 in Pictures. Below you will find some of my favorites.

Have I mentioned how much I love Boston Big Picture? The truth is, I saw the name of their latest article and didn’t even see the pictures, but I knew I had to write a post about it. They are always that awesome, that I never pre-screened it and picked the images as I went along. I had to restrain myself from including more from the post, because there are so many awesome ones.

Do yourself a favor, go and check it out, you will thank me later.

Stop Bashing MBAs!

Yes, I get it. Many folks with MBAs did leave their ‘Ivy League’ school for outrageously high paying jobs in finance on Wall Street and ostensibly cause the financial crisis of 2008. Yes, I get that many of them actually invented the CDOs that were at the heart of the melt down.

Yes, I get that some MBAs leave school with a superiority complex and tend to abuse their privileged positions of management – by either being incompetent or abusive or worse both.

Yes, I get that many created dot-bombs in the 90s with the expressed purpose of just raising money in the boom boom days, and hiring ‘lowly developers’ to create their star product and go public.

Yes, I get that many VCs and finance guys have MBAs and have become the scorn of the entrepreneur. Yes, I get that VCs have abused their power which bred resentment.

I get all of that.

But when did wrong begett wrong? When did it become acceptable to paint with a broad brush and label all MBAs as the cliche’d stereotype?

It is very disappointing to see many people, within the tech industry, that I have previously looked up to make such a mistake as generalizing.

Saying that MBAs are not a good fit for startups, is like saying that doctors, lawyers, teachers are not good for startups. What rubbish is that?

I am a geek, by almost any standard, but I also love business. After completing my CS degree, I decided to go to Business School because I figured it couldn’t hurt. Guess what, it turned out to be the best decision of my life.

Separate and apart from the core business analytical skills it taught me – i.e. statistics, how to read company financials in & out, the fundaments of economics (micro and macro), etc. – more importantly it taught me what it is like to work in teams, constantly. Many times under severe pressure with looming deadlines and a ridiculous amount of work. It taught me how to deal with that nimrod on my team that doesn’t know how to communicate and how to do simple tasks that any high school grad should be able to do. It taught me how to step up to the plate when there is a leadership vacuum and everyone else on the team is afraid (including myself) of the large task ahead. It taught me how to step back when there are too many leaders and know when to follow when someone is better fit in a situation than I am.

It taught me how to encourage strengths and replace weakness on a team. It taught me how keep track of key milestones, deliverables and the likes, to get to a key goal on time. It taught me how to negotiate (with teachers, other students, administrators, bosses, financiers). It taught me how to be resourceful in finding the funding to complete my education when in the last two semesters, my main source of funding dries up at the beginning of what we now know is the Great Recession.

It gave me a passion for economics and finance. It taught me about the VC side of the transaction (how to run a VC firm and what they are looking for) if I am ever looking for financing. It taught me about free markets (both their perils and wonderful advantages). It taught me how to balance all of the above while working part-time (remotely) and being married (and going through a pregnancy and first year of my child’s life).

All of which I am certain will help me in all ventures I pursue in the future (not just startup opportunities – but non-profit teams I will be a part of, any political organizations I join, sports team I coach, etc.). It has drastically changed my world view, and I am all the more grateful for it – especially when I watch the news and see all the shenanigans going on and understand what is happening – knowing when the politicians (on both sides of the aisle) are simply playing games and misleading the public.

So yes, we MBAs have been jerks in the past. I apologize on their behalf. But, I beg of you…please…please…let’s stop with the hasty generalizations and the MBA bashing. Time to put that meme to rest.

P.S. Image courtesy of adobemac on Flickr.

Greece Debt Crisis Explained - Part Two

In the first part of this series about the Greece crisis, we looked at the causes of crises in general and some of the elements that led to Greece’s crisis specifically.

The single most important factor in financial markets is confidence. Confidence in everything. From the political system to strength of the local currency to regulators to central bankers. In October 2009, the new Greek Prime Minister shattered market confidence by announcing that several revisions have to be made on their reported numbers (i.e. they have been lying) starting with the budget deficit being double previous estimates @ 12.5% of GDP. As a result of that announcement, which was the absolute right thing for the new Prime Minister to do, the credit ratings agencies downgradedGreece’s debt.

The new Greek government kept dithering about whether or not they need assistance. To further compound the issue, the EU and IMF were back and forth about whether or not they would come to Greece’s rescue. The first version of the bailout plan was only 25 Billion Euros. Even when this was presented, the markets were still not convinced that everything would be ok. EU leaders and the IMF were forced to go back to the drawing board and come up with a more ‘potent’ solution. A $147B bailout package was put together, that seems to have soothed markets fears about Greece’s problems. However, the steep austerity measures demanded by the IMF and the EU didn’t sooth thefears of the Greeks who will have to pay dearly for the years of profligacy by their elected officials.

Just when things were being contained in Greece, S&P downgraded Portugal &Spain’s debt. This causes panic among investors as stock markets all over the world start to decline. The EU is forced back into a corner, and has no choice but to fight. Come out swinging they did. The EU leaders, IMF and the US put together a $1 Trillion bailout package for all troubled Euro nations.

So, in summary…we have seen a small country that first ‘needed’ a $25B bailout, turn into a large $1T bailout for the entire EU (basically). What exciting times we live in. If it is one thing these regulators seem to have learned, it is that fear and uncertainty can spread contagion all over the world in no-time flat. They seem to have tried to get in front of it this time. Although…there are early signs that there are still doubts. Hopefully, this is another crisis diverted.

P.S. Image courtesy of chrissys575 on Flickr.

Greece Debt Crisis Explained - Part One

What causes a government debt crisis?

Typically, governments carry a certain amount of debt on their books as standard operating procedure. These are in the form of bonds. A ‘normal’ amount of between 20% – 65% is usually fine, for most countries. This actually works well, because when the fiscal situation of the government is in good order (i.e. when the government is earning enough to cover the interest on the debt + invest in infrastructure and projects that produce growth) the government is actually doing investors a huge service by providing a ‘risk-free’ asset for them to include in their diversified portfolios. The crisis comes about when the government’s debt-to-GDP ratio reaches to dangerous levels (usually 120%+) and the fundamentals of their fiscal situation becomes shaky. i.e. either GDP growth slows/stops, revenue measures are inadequate (taxpayers avoid paying their fair share by bribing officials), spending gets wildly out of control, or any combination of the three. The result of this is that the ability for the government to honor their interest payments becomes in jeopardy.

What caused Greece’s debt crisis?

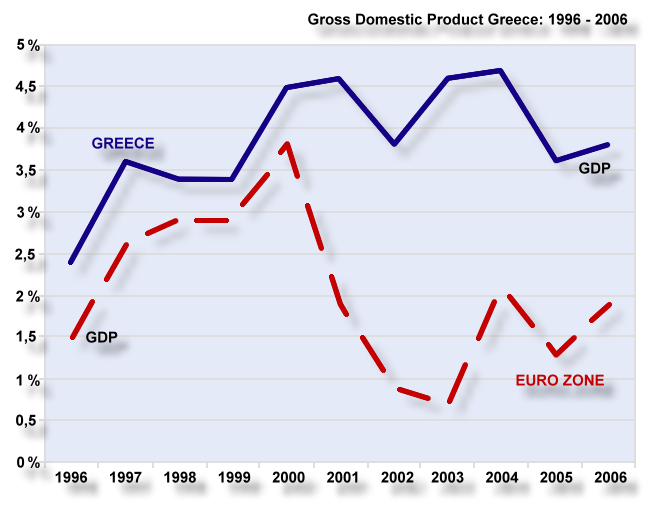

So Greece, unfortunately, has a combination of those factors. According to Greece’s Ministry of Finance (PDF), up to 2007 Greece had GDP growth rates of between 2.5% and 5% from 1996 – 2006. However, as later posts will show, it is important to note that perhaps those GDP growth figures are now to be taken with a grain of salt – as it has been revealed that previous administrations have been ‘cooking the books’. The following image shows a nice comparison of Greece and the rest of the EU during that period:

According to the CIA World Factbook, Greece had estimated GDP growth rates in the latter years of 4% in 2007, 2% in 2008 and -2% in 2009. So while growth has slowed significantly over the years, given that we just came out of a severe fiscal crisis, those numbers don’t look that bad. However, when we look at their other measures we can see the crisis intensifying. Eurostat, an EU agency, recently put out a report (PDF) that paints a damning picture of the Greece fiscal situation.

From the report, one of the things they show are the levels of government revenues (as % of GDP) and government expenditures from 2006 – 2009. This is what it says:

Gov. Expenditures: 2006 = 43.2% of GDP; 2007 = 45%; 2008 = 46.8%; 2009 = 50.4%;

Gov. Revenues: 2006 = 39.3% of GDP, 2007 = 39.7%; 2008 = 39.1%; 2009 = 36.9%;

You can generally see that the trend should be reversed. The expenses should be going down, while income goes up! The increasing expenses can be attributed to generally powerful labor unions, and free-wheeling politicians that promise more than they probably should.

Conclusion

We have seen, in Part One, that the fundamentals of the Greek economy started to falter before the economic crisis hit. In other parts we will dive deeper into what caused the sudden surge in anxiety and possible contagion effects. If you have any questions that you would like me to address, please feel free to let me know in the comments section below. I have a general guide of what I want to cover, but I am fairly flexible.

P.S. Image 1 courtesy of titanas on Flickr. Image 2 courtesy of Wikipedia.