I made a comment in response to a blog post about the Apple vs Samsung case on Hacker News recently - that got a ton more upvotes than I thought it would have (and a few friends of mine encouraged me to write this post), so I thought I would post the jist of my thoughts here.

Apple wasn’t suing Samsung because they ‘copied’ one of their products. What Samsung has done is straight up IP (Intellectual property) theft.

There are many other companies that come out with many features in their products that Apple doesn’t sue. See Windows, Safari vs Chrome, iPod vs Zune, Adobe Premiere vs Final Cut Pro, most “ultrabooks” vs Macbook Air, etc. The issue here is that Samsung, HTC, et al. essentially have done what many manufacturers in China have done (and are still doing).

They acted like a hardware manufacturing partner - then using the inside knowledge they gained of the intimate architecture of the products, they reverse engineered them and competed directly.

That’s like you hiring a web developer to build your startup - and both of you build it to traction, and once you take all the risk and prove the market, (s)he leaves and builds a direct competitor using his insider knowledge. It’s the most insiduous kind of ‘IP stealing’ that exists.

So Apple’s response is perfectly rational.

If you had that done to you, and your ex-developer (in fact, he is still managing your codebase) is making a ton of money off of your ideas and IP in your market, I am sure you would be pissed too. The money is just sprinkling on top…and a definitive statement to other “partners”.

Einstein’s Productivity Is a Model for All Entrepreneuers

The next time you think “I will start {X} another time. I have too much going on now….” consider this.

During the period when Albert Einstein wrote his 4 papers that revolutionized physics (including “The General Theory of Relativity”), he had a few things going in his life….including but not limited to:

- A full-time job in a patent office in Bern, Switzerland where he worked 6 days - 8 hours a day (yes 6 days).

- A relatively new wife (who most of his family hated/despised, at least initially)

- They had a daughter, but there is no record of what happened with the daughter (insinuating that maybe his wife lost the baby or they gave her up for adoption - though there is no evidence to suggest as much). Either way, this must have been taxing emotionally.

- They then had a son - Hans Albert Einstein

- Einstein played in a string quartet once a week.

- He had no access to a library to read other publications (because the library was usually closed when he wasn’t at work).

- Oh…and he had no computer & no Google =)

Even despite these obstacles, he wrote 4 papers that fundamentally transformed physics and subsequently engineering.

Source - Einstein: His Life & Universe

You should probably follow me on Twitter.

The Biggest Problem, for Jamaica’s Tech Industry, Is the Sum of Our Smaller Problems

I just came from lunch with Chad Cunningham and Gordon Swaby. We are trying to figure out, and put into words, the issues facing tech (more specifically internet/web) companies in Jamaica for a meeting with a government official coming up shortly.

After going through many scenarios of issues we face, the recurring theme always came back to the “small problems”.

- Registering an LLC easily & cheaply

- Getting all documentation and tax compliance information in order for everything to be above board.

- Getting health insurance for the owner and the handful of employees (and their families)

- Accepting VISA, Mastercard, Discover, American Express from any consumer around the world

- Doing business with US-based organizations

- Importing any equipment we may need (laptops, computers, networking equipment, iPads, etc.) for everyday use - with a predictable cost. Right now, you never know what the end cost will be once the various duties and levies are attached.

Right now, all of the above are a headache in one way or another.

I have had to register a US-based Delaware Corp to get a US bank account to allow me to get a US payment processor account to process US-issued credit cards. All of that was easier (not easy) than working with the local banks. Not to mention that the local banks don’t process (the last I checked) Discover and American Express issued cards.

Gordon eloquently summed up our current problems with this phrase that I love so much that I had to write a post about it.

“Our biggest problem is the sum of our smaller problems.”

- Tech startups don’t need a government run Venture Capital arm - what we need is a regulatory & justice system that allows investors to purchase preferred shares (or even common shares) in our companies and be adequately protected (both from culpability & liability for the wrong-doings of any companies they invest in). Just like a typical equity investment in the US.

- Tech startups don’t need a government run health insurance program - what we need is to be able to buy insurance from the existing entities on similar terms that any individual can get by joining Churches Credit Union, or JN.

- Tech startups don’t need large tax incentives because our net margins are high, and paying taxes is a good problem to have.

- Tech startups don’t need any government land or buildings - because we can get by in our own homes/garages/offices.

- Tech startups don’t need special treatment - all we need is fair treatment. We need the government to either issue new banking licenses to encourage competition in the banking industry - specifically to a bank interested in specializing in e-commerce transactions. From selling products online, to managing subscription payments in Software-as-a-Service (SaaS) apps. Or heavily lean on existing institutions to be more e-commerce friendly, although…the skeptic in me thinks we would be better off with good old-fashioned competition. Issuing a new banking license to an entity interested in mobile & e-commerce would probably be the best bet.

- Tech startups don’t even need import waivers, we just need certainty. We need to know that if we are bringing in an iPad, once it touches the shores we will be paying a flat fee (that is reasonable, 50%+ is NOT reasonable) for duty. We already know, via Mailpac, what the flat fee for the shipping will be. We need to know all the other flat fees.

Once those problems are fixed, the last thing we need is for JAMPRO to tell the world that Jamaica’s tech industry is open for business.

Show investors that there is a clear path to liquidity via our Junior Stock Exchange and JSE (especially through a USD offering).

In short, we just need the government to streamline the basic issues that we have to deal with - i.e. the “small, every day problems”, and we will take care of the rest.

If you liked this post, you should follow me on Twitter here.

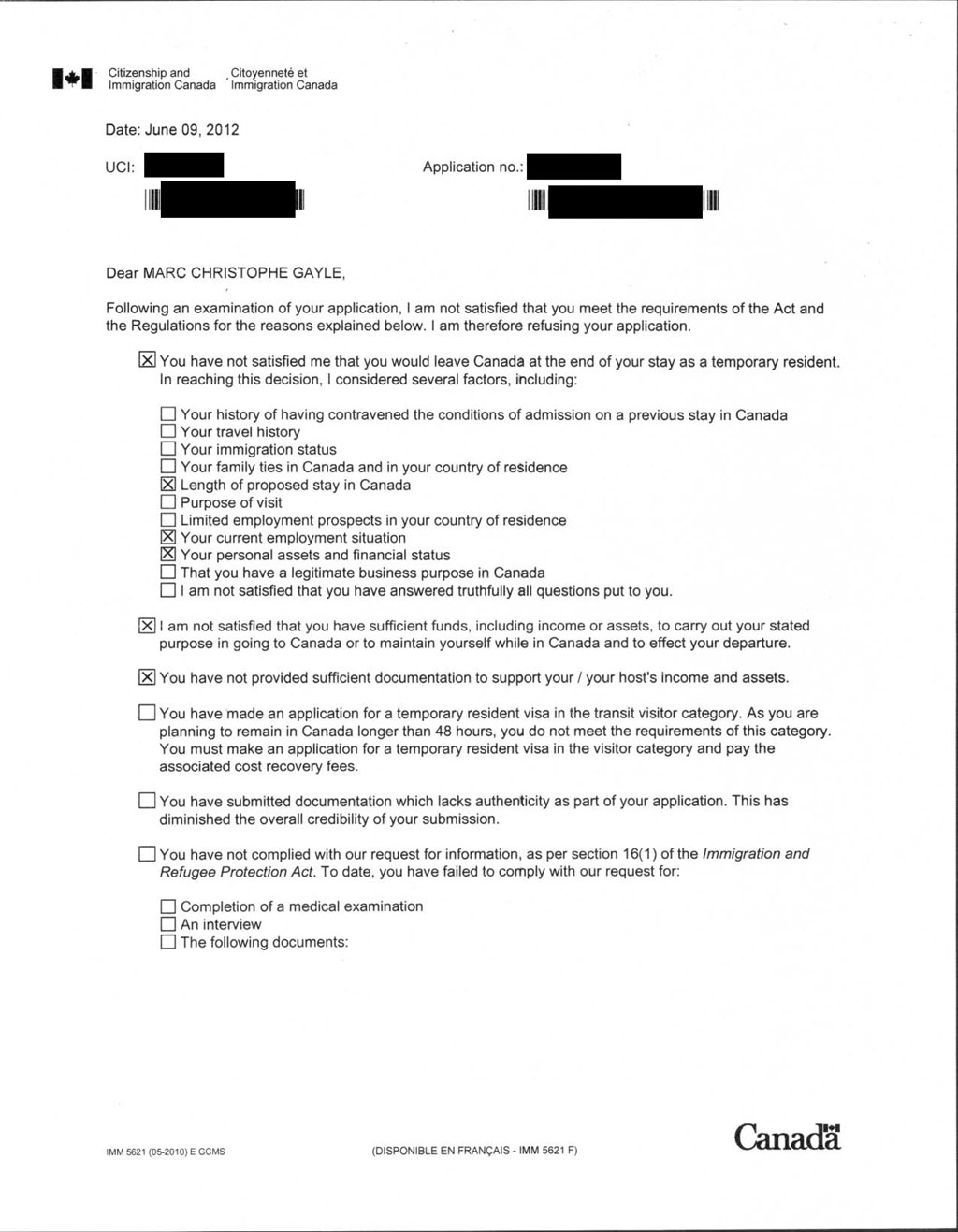

The Life of a Bootstrapper - Canada Denied Me a Visitors Visa Because “I Am Too Poor”

Update: I re-applied with additional information about my business and financial situation and they approved the visa for 2 - 3 years.

I recently applied for a visitors visa to Canada (officially known as a ‘Temporary Residents Visa’) because my best friend is getting married in July. I went to Canada about 3 years ago for his brother’s wedding - around the same time of year - and it was nice. I have been looking forward to the trip.

Granted, I had my suspicions that my application was weaker than it could be - for a number of reasons.

I am a bootstrapper. A few months ago, I started doing freelance web development to pay the bills. The issue with that is the cash flow fluctuates significantly. So when a good month happens, I have to put aside for slower months.

Needless to say, I couldn’t provide a ‘job letter’ or show any ‘proof of employment’ to a Jamaican company that requires that I live in Jamaica - because no such thing exists. The best I can do is show company registration documentation, and bank account statements in all my bank accounts (locally, and US-based). Also, the application process has collided with a “slower period” - so the bank statements are not flattering, to say the least.

I don’t own where I live, I rent.

I purposely chose not to use my parents as financial support, because…well…I am almost 30 and have 2 kids (with 1 on the way). Plus…I earn my own living (kinda), damnit!

Before deciding to go down this road, I read ENDLESS stories and blog posts about others that have trod a similar path. I debated doing something where I raise money, or bootstrap. I hated the idea of losing control and I seem to have an affinity to doing things the hard way (not that raising money isn’t the hard way).

One of the things I didn’t quite realize is that even though you are bootstrapping, life doesn’t stop. You still need to interact with institutions that don’t understand the concept of a bootstrapper or even the startup life or even freelancing.

So let this be another data point you should consider when you think about bootstrapping. I always thought, “nah…that will never happen to me”. Seems it’s more the rule than the exception.

Now, it seems, I will be missing my best friend’s wedding in July.

I read about rock-bottom, but never knew what it felt like. I know you might scoff “Pfftt…I used to live in my car”, but compared to what I am accustomed to, these last few months have been pretty damn hard and this almost feels like the nail in the coffin.

I am a pretty private guy, but I didn’t know what else to do other than let it all out.

The worst part about this all, is that I can’t see myself doing anything else - no matter how tempting it may be.

In other news, I am working on another product that I hope to launch in the coming days/week. If you are a freelancer, and want to find new business leads easier, follow me on Twitter so you can know when I launch that.

Can’t stop, won’t stop.

This is the life I chose, or better yet, the life that chose me.

The Simplicity of Apple

My mom just got a Macbook Air for Christmas, and I got the wonderful job of setting it up for her. I am a geek and for some reason, even though my Macbook Pro is about 2.5 years old, I get giddy just holding such a small but sturdy form factor in my hand. I might seem like a fan boy, but I am a cautious one. Even though I do development on my MBP, I still have a Windows 7 machine (dual-monitor) for ‘everyday use’. I can’t quite make the jump fully.

Anyway, back to the migration. I started thinking like I would for any normal PC migration. Where are the Application CDs, let’s get an external hard drive to track down her files and move everything there - then from the drive to the new machine. I immediately started to wrack my brain to figure out where her ‘profile’ files are stored - i.e. when you are doing a PC migration, to save your bookmarks and browser information (pre-Chrome sync), you had to manually search for those files in My Documents and transfer them.

I also started thinking about setting up iTunes and adding the new files and folders to iTunes so she can find it EXACTLY the way she had it - otherwise I would get ENDLESS support phone calls about finding her music and other media files (which I just treasure to get - Hi Mom :))

So I boot the Macbook Air, and about 2 screens in, it asks me for WiFi credentials. I enter password and move on. ~2 screens later it asks if I want to migrate anything from an old machine.

“Holy crap” I think…this cannot possibly be suggesting what I think it is.

I see a screen that looks like it is scanning for a WiFi network with some directions (go to old computer, go to Applications -> Migration Assistant and select the option ‘Migrate FROM this computer’). I do that, then come back to the Macbook Air. It finds my mom’s old machine, and asks me for the verification code that’s on her screen. I confirm it, and press ok.

It then calculates the amount of things that need to be migrated, 13.5GB.

5.3GB of which are APPLICATIONS. “No way, I think. That can’t be possible.”

So I press continue and it goes. I leave it for about 6 hours while it transfers everything via WiFi from the old machine….I go back to the Macbook Air….literally everything is transferred. Office is installed and registered with the same product key (as her old machine) and in her name, Skype is installed with her credentials, it even transfers her OS X username and password, all her documents, pictures, music and movies. Dropbox is installed and configured properly and everything is in it’s place. The only thing that had a problem was an HP utility app for her printer/scanner. So I went online, downloaded the latest drivers and installed that - like I expected to have to do for everything else.

That’s it….everything installed. All programs setup, all documents in place, iTunes works with all her music, everything.

From an OLD computer to a brand spanking new one, with everything intact, with a few clicks + a few hours waiting for the transfer via WiFi, then a few corrections.

I don’t think I will ever be able to do another PC migration and not be more annoyed than I used to be.

Mind. Blown!

P.S. You can follow me on Twitter here.

Development Has Built-in Network Effects

It just occurred to me that the more you actually build stuff, is the easier it is to build stuff.

Not only because you get better, but because your library of solutions expands…which encourages you to build more stuff (because you are creating less ‘novel’ pieces of your new project) which expands your library even more and makes you even better. Creating a virtuous positive cycle.

That happened to me just now. I needed a divider, something simple, elegant, doesn’t involve a GIF or any images, and pure CSS. Well, I remember struggling with this for CompVersions, so I painstakingly took the time to create one.

It’s nice, simple and very elegant.

I literally just copied and pasted that one CSS rule from CompVersions to my new project and added an empty div…BAM! Perfect divider.

Yes, I am a relatively n00bie ‘full-time’ developer, so these sorts of ‘obvious stuff’ are just now clicking with me - so you have to forgive my bouts of spontaneous joy when I come across them.

I imagine there must be other professions where this is true, take Law for instance (where you have a sample contract that is just re-used as the basis for all future contracts) - but it never occurred to me that it would be so powerful for development.

Btw, for anyone interested, here is the code for the divider:

You should follow me on Twitter here.

Hacker’s Guide to Cashflow vs Profit

Had a wonderful time at Kingston Beta last night.

There was a point brought up by one of the presenters that entrepreneurs should focus on cash-flow instead of profitability. There were a few questions and I don’t think that the questioners fully understood, so I figured it was time for a post to try and explain (if I am still not clear, let me know in the comments).

—–

Cash Flow

Simply put the flow of cash in and out of your company. Cash can flow in from three sources: Operations, Investments, Financing.

Operations - This is what your business does. If you are a doctor, your cash INFLOW from operations would be what your patients pay you (as well as health insurance companies), while your cash OUTFLOW from operations would be what you paid your secretary, the office supplies you bought at the store yesterday. If you sell books, your cash INFLOW is the cash that your customers pay you for the books. Likewise, your cash OUTFLOW is the cash you then hand over to the distributor that you got the books from that you sold + the expenses you had to pay (utilities, etc.).

Investments - Say your business is doing really well and you always have excess cash in your bank account every month after you have paid all your expenses, it is fiscally prudent to put that cash to work rather than letting it sit idle. Either by investing in your company (say opening a new branch, or buying new manufacturing facilities or new servers, etc.) or by investing in some security (buying government bonds, or stocks of publicly traded companies, etc.). The cash OUTFLOW is what happens when you spend the cash initially to make the investment. The cash INFLOW is what happens when your investment pays you (e.g. a stock that you own pays a dividend) or you sell that investment and get back cash. Most startups won’t do this though, because in the early stages of a company you can usually get a better bang for your buck by investing in your own company and growing it until you reach the point where you can get better returns elsewhere.

Financing - This usually involves raising money for your company. If you are startup, then that usually means that you are raising a round of Angel/Venture investment. Your cash INFLOW would be when they wire you the money. The OUTFLOW would only occur when the company is either sold, or you have enough cash to buy by the stock from an early investor/founder once you reach later stages. This is more and more common now, than it was a few years ago. From the Founder’s perspective, it is typically said the Founder is ‘taking money off the table’. Meaning, they are cashing out a small portion of their stock - the idea here is that it allows the founder to swing for the fences and go for a big IPO or a big acquisition without feeling like they will lose it all.

Profit

Profit is the amount of money you have received in income (typically from operations) that you have left over after you have paid (or accounted for) all expenses in any particular period.

However, this metric is fuzzy. Here is why.

Say you sell security software to enterprises. Each enterprise license is $5,000/mo. All customers have to buy in annual contracts, so each contract you sign is worth $60,000 USD, all things being equal. However, most enterprise contracts don’t pay you the entire $60,000 upfront. They might pay you $10,000 now, then another $10,000 every 2 months for the next 10 months. Or they might pay you $30,000 (half) now, and say they are going to pay you in 2 months. But in 2 months, they say they need another 2 months, and keep doing that for the entire year. In some cases you will eventually get the money, but there are the occasional cases where you don’t. If you don’t manage your cash flow you might incur expenses in anticipation of that revenue that might come too late or not at all.

That’s how companies go out of business.

For instance, say you sign up 10 of those contracts in month one. You feel happy. You just ‘made’ $600,000. If you bulk up and hire $600,000 worth of labour in month 1, to invest in product development and supporting this new contract, you could find yourself in a situation where you don’t have enough money to pay their salaries. If that happens you have at least three options a) lay them off - and face possible legal action depending on local labour laws, b) explaining the situation to your employees and asking them to forego pay - this too might expose you to legal action or c) getting more business to make up for the shortfall.

This is just month 1. Typically what leads companies to go out of business is this happens in too many consecutive months with too many clients and you get caught flat-footed or too underwater and can’t get a short-term loan to bridge you over until your customers pay.

That’s why, as a startup, it is fiscally prudent to focus on becoming cash flow positive - which basically means that every month you are taking in more cash than you are spending.

There are two obvious ways to do this:

- Increase your ability to collect from customers (i.e. increase the % of customers that actually hand over cash)

- Extend the time period you have to pay your bills. For some things it’s harder (e.g. utilities, wages, etc.), but there are some things that you buy that you can usually get a break on - that give you another 30 - 60 days to pay.

Once you understand these concepts, you can then understand why companies like Twitter, Facebook and GroupOn work the way they do.

Very briefly, here are some thoughts on the way these concepts affect those companies - without me having any internal knowledge of them, just speculating based on what is available in the public domain.

Twitter - The most famous thing to be said about Twitter is that they are not making any money. So let’s assume that they are actually not earning any money (even though that’s clearly not true from the Promoted Tweets and other advertising we see creeping into Twitter slowly but surely), the way they stay alive is by continually raising rounds of financing. According to Crunchbase they have raised about $1.16B to date, in 8 different rounds of financing. So they can use the money from investors to pay their monthly bills while they figure out how to make money.

Facebook - While on the surface looks similar to Twitter, with $2.34B raised in 11 rounds, in 2009 they announced that they were cash-flow positive (meaning they took in more cash every month than they spent). That doesn’t mean that they are profitable, but that definitely is a great sign. It indicates that they can continue growing and are in no immediate threat of going bankrupt.

GroupOn - They too raised many rounds ($1.14B over 6 rounds, according to Crunchbase as a matter of fact), but they have been famously not-profitable. They have also been expanding rapidly - in January 2011 they were at 4500 employees up from 3000+ in November the year before. So how have they been able to keep up that dizzying pace of growth? Not just venture financing….it’s also how they treat their revenue. What they do is collect the total amount of the coupon (say $50 for $500 worth of pink high heels??), then they pay out say 50% of the $50, so $25 to the store at some point in the future. The longer they can hold on to that $25 that they have for the store, is the more things they can do with it.

So while most companies do try to extend the amount of time they have to pay their vendors, GroupOn seems to have it baked into their revenue model.

In my humble opinion, that’s not sustainable and that’s just one of the many reasons that investors have been crying foul over GroupOn’s filings.

One last example of a company that is ‘highly profitable’ but can go bankrupt from lack of cash is what we saw happened with GE in the middle of the credit crisis. GE made about $12B in profit in 2010, on revenues of $150B. However, a big portion of the stuff they sell (airplane engines, locomotive parts, MRI machines, etc.) are very expensive. So they extend a line of credit to their customers. So even though they have booked an accounting ‘profit’, they don’t collect the cash from their customers very frequently for those sales. What they do is go to the investing public and sell investing products very frequently. To see all the ways you can ‘invest’ in GE check out this, this, this and this. As a matter of fact, while I was doing research for this post, I learned something I never knew before….apparently GE issues commercial paper in 1-day increments. That means, they will borrow money from you for 1-day and pay you back the next day - with interest of course, but there is a catch.

Range of Maturities

Commercial Paper is generally offered from 1 to 270 days.

Minimum Investment Amount

The minimum is $100,000 for transactions with a term of seven days or more. For transactions with a term of one to six days, the minimum amount is $500,000.

That completely blows my mind. I am used to seeing 1-year, 10-year and 30-year maturities on bonds. But 1 day? WOW! That really shows you that they need the cash every day just to keep going.

So in the middle of the crisis, when they could no longer borrow for 1-day, they ran out of cash (literally overnight). They had to apply to the US gov’t for a temporary life-line.

If they didn’t get that, large sections of the company would have been in trouble (if not the entire company).

So that’s why it is better advised to focus on becoming cash-flow positive and not ‘just’ profitability.

I hope that helps with any confusion around this topic.

If you like this, you should follow me on Twitter here.

Tab Debt

The act of accumulating a number (say ‘n’) of unread/unprocessed tabs left open in a browser window such that the next day rather than starting with 0 tabs open, you start with n.

Also can be summed up as: X = X + Y,

where X = the number of tabs open at the beginning of the day,

and Y = the number of tabs opened throughout the day.

This has become a major problem, so much so that when my browser crashes and I am forced to start over, I actually breathe a sigh of relief as I start from a fresh canvas.

Every single day I start the day with both my browsers looking like these two images:

So many tabs that I can’t even see the name. It’s not long before I I can’t even see the favicons.

Btw, these are tabs left open after I have sent those that I can send to my Kindle and closed those.

This is almost as bad as having an unwieldy inbox. But what is the solution to this?

I would love some help with this problem, because it is becoming more ridiculous by the day.

Help!

P.S. You can follow me on Twitter here.

President Obama You Lied

Please don’t get me wrong. I am one of those people that supported your nascent campaign once you declared in Illinois. If I could have voted in 2008, I would have voted for you.

Even though I am not Congressman Wilson, I have to say it, you lied!

You have said that you would rather be a really good one-term president, than a mediocre two-term president.

As is evidenced from the way you recklessly managed the debt ceiling issue, you clearly had the 2012 re-election campaign in your sights.

The right thing for the country, and the world, would have been for you to stick to loose fiscal policy in the immediate-short term, and lay out a credible medium term plan for reigning in the deficits and paying down the debt once the economy has fully recovered. But you did just the opposite - with allowing the Republicans to cajoling you into short-term spending cuts and shirking the responsibility for the real tough decisions (like tackling social security, and medicare reform) to a Congressional Committee.

The ironic thing is, as you can see from the markets reaction, if the economy continues to deteriorate and slips back into a recession just in the nick of time of the next re-election - you will likely be the worst combination of what you wanted.

A mediocre one-term president.

That would be a travesty, because you had so much potential.

A Simple Solution to America’s Social Security Problem

TL;DR - Legalize all illegal immigrants and have an open immigration policy that makes up for the shortfall in the workforce.

Long version

The way Social Security works is, every dollar you pay in taxes today, goes to paying the check for a retiree.

To get a full appreciation for the Social Security Problem, let’s run some quick math.

Let’s assume that each Baby Boomer is retiring at the age of 65. Also assume that each retiree lives for 30 years after retirement.

Also assume that each retiree is expecting to get $45K/year - which is likely to be VERY conservative, but, for simplicity’s sake let’s just use $45K/year.

Each retiree would have to be paid $45K * 30 years = $1.35M during retirement (let’s round it up to $1.5M to make it easier on the math).

Also assume that there is a gap of about 30 million people, meaning there are 30 million more people retiring (i.e. baby boomers) than there are replacing them (i.e. young people entering the work force for the first time) - and the gap could be wider, but for math’s sake, let’s go with that.

That means, it’s: 30,000,000 people * $1.5M = $45,000,000,000,000 (i.e. $30 Trillion)

This ignores the health care related expenses for those retirees. This is a major problem, and this is what people mean when they say that Social Security is ‘unfunded’. i.e. there is a chunk of retirees that have no one just entering the workforce that will support them.

Solution: Expand the workforce to be greater than the number of retirees. i.e. Legalize all the illegal immigrants and open the gates so anyone can come and work in America….up to a comfortable number over and above the number of retirees.

Obviously, I know there are political consequences to making a move like this and other repercussions, but if America’s leaders were honest enough about this solution they would start having this debate and figuring out how to solve it properly. This solution would also have to be done in tandem with other things like raising the retirement age, migrating from Defined Benefits to Defined Contribution, etc. But, by far, this solution would take care of the major driver of the problem - that more people are retiring than entering the workforce.

It really is that simple.

You can follow me on Twitter here.