Doing a Quick Survey

NAFTA Visual Comparison-Canada vs. US vs. Mexico

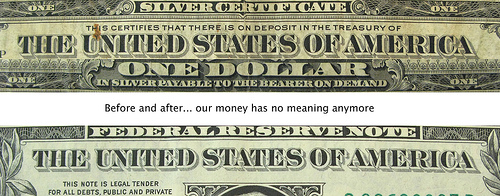

Did You Know? Globalization and the Information Age

[youtube]http://www.youtube.com/watch?v=jpEnFwiqdx8[/youtube]

The video was created by Karl Fisch and modified by Scott McLeod.China vs. United States [Graphical Comparison]

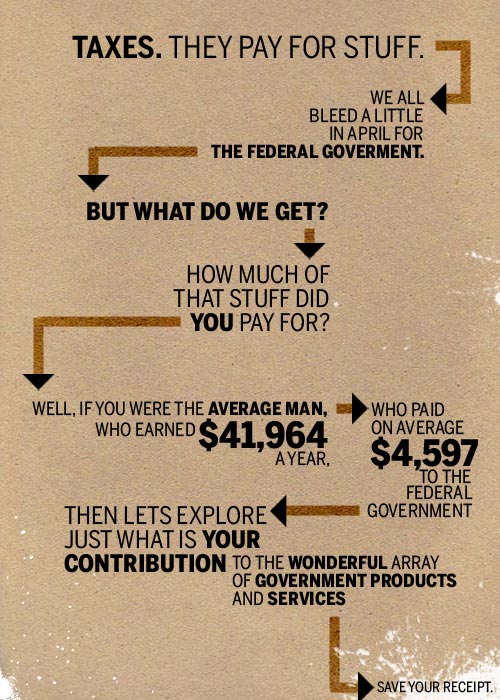

Where Do Your Federal Tax Dollars Go? [Graphic Illustration]

Goldman Sachs Executive Compensation 18% Higher Than Q1 2008

Why Does the Federal Reserve Intervene? [Flowchart Graphic]

This decision tree summarizes how the Fed responds to potential financial crises. After getting a reading on the economy’s vital signs, the Fed determines whether the threat at hand might compromise the central bank’s three primary goals.

If the Fed sees little risk, no action is taken, avoiding moral hazard and leaving the markets to sort out the difficulties. The Fed reacts this way to nearly all potential troubles in the financial sector.

A pervasive threat to the overall economy or the financial system can justify direct action. The Fed rarely makes these interventions; when it does, it strives to manage the resulting moral hazard in the least costly way.

The first choice entails the Fed’s acting as an outside coordinator to bring together private institutions to defuse the threat. It’s a strategy that minimizes public-sector risk, and the central bank used it with the Long-Term Capital Management hedge fund in 1998.

When this option isn’t feasible, the Federal Reserve Act provides the authority to deal directly with pressing threats. The preferred strategy involves forging partnerships with private institutions, a course the Fed took in March 2008 with Bear Stearns, a troubled investment bank and brokerage with sufficient remaining collateral to support the intervention.

When private partners aren’t willing to step up, the Fed can act alone if troubled firms still have sufficient collateral. In September 2008, the Fed arranged a purely public intervention for AIG, a huge financial services company.

If remaining collateral is insufficient to support taxpayer-financed actions, the Fed under current law is obliged to let the markets decide a troubled firm’s fate. The Fed accepted this outcome with Lehman Brothers in 2008.

The Average Man’s Tax Dollars

Is the Financial System Showing Signs of Recovery?

One sign would be that a large bank is successful in raising private equity. Right now, all the private money is sitting on the sidelines saying ‘we don’t know what these banks are worth’, ‘we don’t know that they are stable’ and they are not willing to put their money in the banks.